In a world where financial services are just a tap away, banks must think beyond traditional marketing to captivate today’s digitally driven customers. The era of flashy billboards and generic ads keeping clients loyal is long behind us. Now, it’s all about creating meaningful, personalized experiences that speak directly to customers’ unique needs and lifestyles.

The best banks marketing strategies combine creativity with advanced technology, using data to predict trends, engage customers, and build lasting relationships. In this article, we’ll explore innovative marketing approaches that boost visibility and create trust and loyalty in the growing banking industry.

What is bank marketing?

In fact, bank marketing is the strategic process by which financial institutions boost their services, build brand recognition, and promote customer relationships. Effective banking marketing doesn’t just inform customers of available products and services. It creates meaningful experiences that align with their financial goals and preferences. Bank marketing requires a profound understanding of consumer needs and behaviors, coupled with the ability to engage customers through tailored and interactive communication.

Its core aim is to position the bank as a trusted advisor, not just a provider of services. This approach goes beyond promoting products like loans, credit cards, or savings accounts; it fosters long-term relationships by consistently delivering value in every customer interaction. A well-crafted bank marketing strategy for banks integrates digital tools, data analytics, customer segmentation, and an omnichannel approach that engages clients wherever they are—whether online, on mobile, or in-branch.

One of the essential elements of modern bank digital marketing is personalization. Customers today expect customized solutions that speak directly to their unique financial situations. By employing customer data, banks can segment their audience into different groups based on their needs and behaviors, delivering relevant offers and content that resonate personally. This emphasis on customer segmentation makes you, the reader, feel understood and catered to.

For example, millennials may be more interested in mobile banking solutions, while older customers may prioritize secure retirement savings plans. Banking marketing recognizes these differences and adapts messaging accordingly, creating targeted campaigns that feel personal and relevant.

Digital channels, from email marketing and social media to mobile apps and websites, are at the forefront of banks marketing efforts. Banks must maintain a solid online presence, providing customers with convenient access to their services while offering engaging, informative content. But marketing doesn’t stop at acquisition—retaining customers is equally critical. This focus on customer retention makes you, the reader, feel valued and integral to the process. Loyalty programs, seamless customer service, and ongoing engagement through personalized offers are all part of an effective bank marketing strategy that keeps clients loyal.

Importance of marketing for the banking industry in 2025

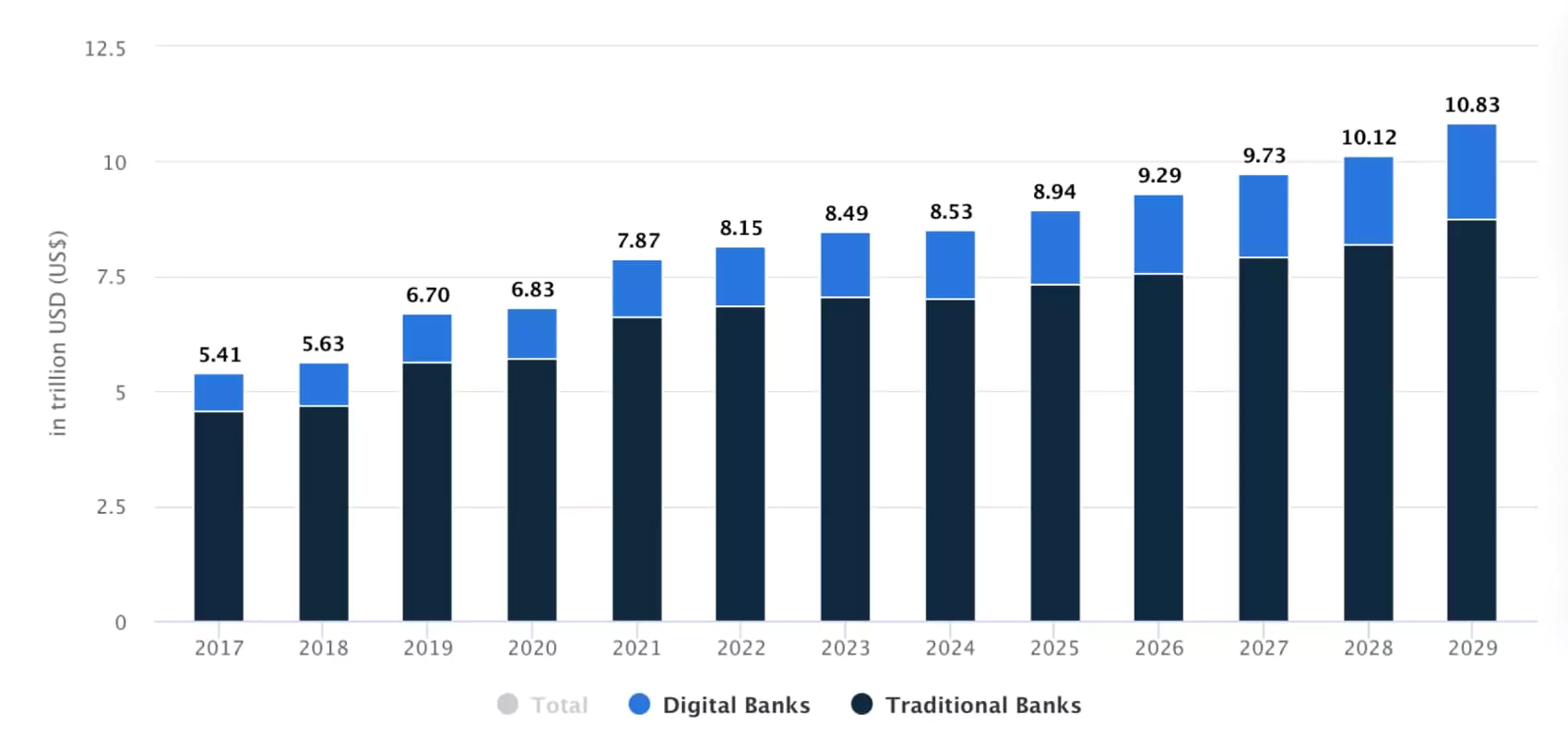

As we look ahead to 2025, the bank marketing industry is poised for transformative change, making effective marketing more crucial than ever. According to a Statista report, in 2024, the global banking market is expected to see net interest income (NII) soar to an impressive US$8.52 trillion. This increase is projected to drive the market volume to US$10.83 trillion by 2029.

The convergence of progressive technology, growing consumer expectations, and increased competition from fintech disruptors necessitates a strategic banks marketing approach that attracts new clients and retains existing ones. Nowadays, banks must use innovative marketing strategies to stand out and remain relevant.

Read also: 15 Content Marketing Metrics to Track for Success

One of the fundamental drivers of marketing in banking sector is the rise of digitalization. Consumers increasingly embrace digital banking solutions, expecting seamless and personalized experiences at their fingertips. In 2025, marketing will be essential in guiding customers through the digital field, helping them guide various financial products and services. Banks that can effectively communicate their unique value propositions and deliver custom solutions will be better positioned to meet the expectations of a tech-savvy customer base.

Moreover, as customer preferences move toward transparency and ethical practices, banks must use marketing to build trust and demonstrate their commitment to responsible banking. Effective banks marketing strategies will highlight a bank’s ethical practices, community involvement, and customer-centric initiatives. By doing so, banks can differentiate themselves from competitors and foster long-lasting loyalty among customers who value these principles.

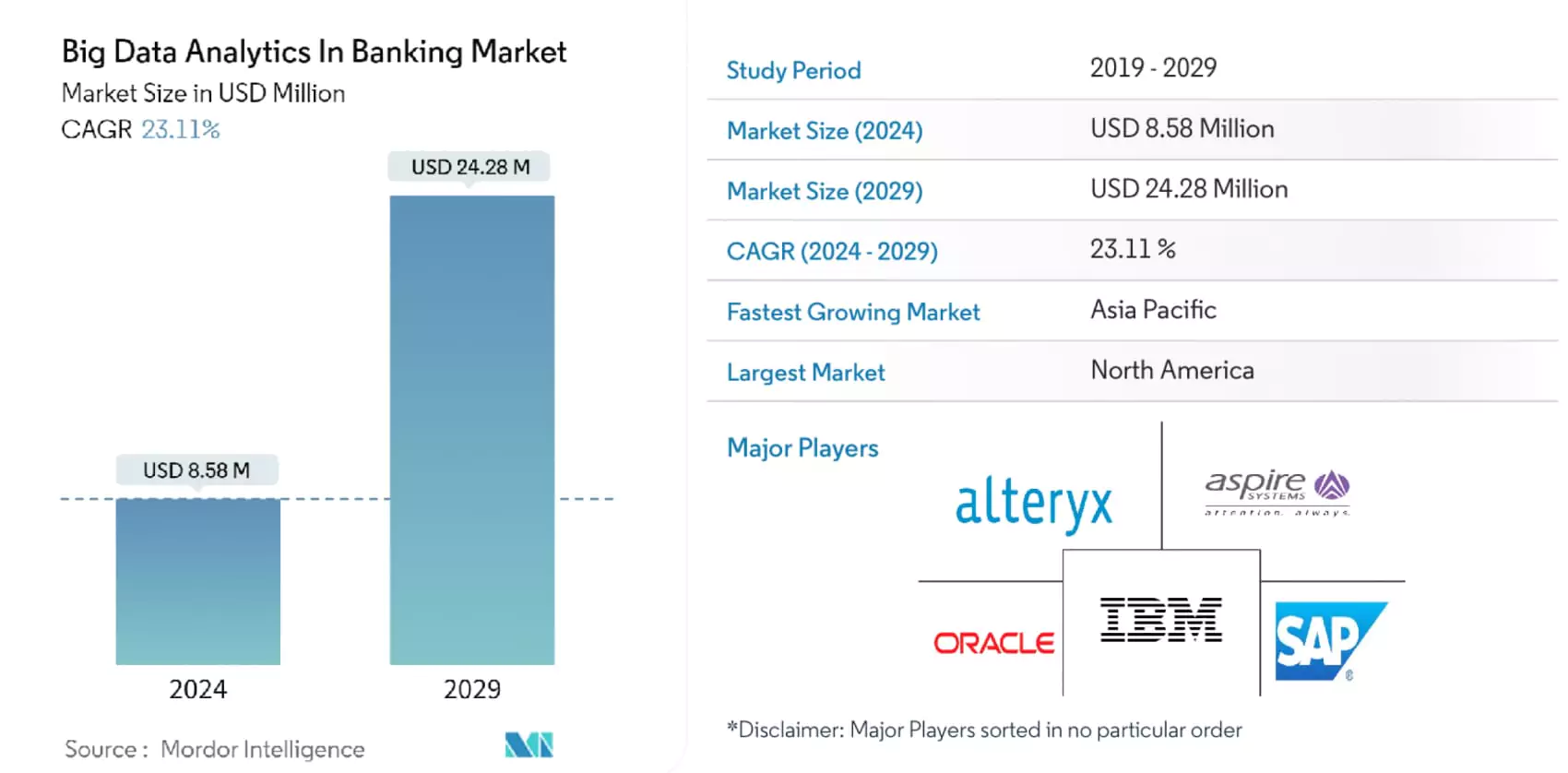

Data analytics will also be a significant shift for bank digital marketing in 2025. The big data analytics in banking market is projected to grow from USD 8.58 million in 2024 to USD 24.28 million by 2029, with an expected compound annual growth rate (CAGR) of 23.11% over the forecast period.

With vast amounts of customer data, banks can gain deep insights into consumer behavior, preferences, and pain points. This information will help them to create highly targeted marketing campaigns that resonate with specific audience segments. Banks can use predictive analytics to anticipate customer needs, deliver the right products at the right time, enhance customer satisfaction, and drive growth.

On the other hand, the increasing integration of artificial intelligence (AI) and automation in marketing will revolutionize how banks interact with their customers. Chatbots, personalized email campaigns, and AI-driven content recommendations will streamline communication, making it easier for banks to engage with clients. This level of customized interaction will improve customer experiences and conversion rates, guaranteeing that banks maximize their marketing investments.

The most effective digital marketing strategies for banks in 2025

To remain relevant and thrive, banks must adapt their marketing strategies to meet customers’ changing needs and expectations. Here are some of the most suitable banks marketing strategies depository institutions can utilize to improve their presence and foster stronger client relationships.

Social media marketing (SMM)

This banks marketing approach presents an invaluable opportunity for banks to engage with customers, showcase their offerings, and enhance brand awareness. By utilizing SMM and platforms such as Facebook, Twitter, LinkedIn, and Instagram, banks can share informative content, address customer queries, and participate in community discussions.

Banks can employ various content formats like infographics, polls, and live Q&A sessions to foster interaction. For example, hosting a weekly “Money Matters Monday” on Instagram Live, where financial experts answer real-time questions, can help demystify banking products and build trust with the audience. By using attractive visuals and relatable language, banks can humanize their brand and resonate with younger demographics.

Moreover, engaging with customers through direct messages and comments can strengthen relationships. Responding to feedback, whether positive or negative, showcases a bank’s commitment to customer service. User-generated content campaigns, where customers share their banking experiences using a specific hashtag, can also create a sense of community and encourage brand loyalty.

Read also: Top 10 SEO Agencies for Small Businesses in 2025

Standard Chartered

This bank has effectively used SMM to promote its “Women in Technology” initiative. Sharing inspiring stories of women in tech through engaging videos and posts, it strengthens its brand identity and connects with potential customers on a personal level. Such a bank marketing approach highlights the bank’s commitment to diversity and community empowerment, positioning it as a socially responsible institution.

Search engine optimization (SEO)

Discussing marketing for banks and financial institutions, visibility is essential. SEO is critical for banks to guarantee the high website ranks in search engine results. By optimizing their site for relevant keywords and creating valuable content, banks can attract more organic traffic and boost user experience (UX).

Banks should focus on long-tail keywords that reflect their specific services, such as “best savings accounts” or “how to improve credit score.” By creating informative blog posts, FAQs, and guides around these keywords, banks can establish themselves as thought leaders in the financial space. This attracts new customers and helps retain existing ones by positioning the bank as a reliable source of information.

SEO involves optimizing individual pages on the bank’s website to improve search rankings. This includes optimizing meta titles, descriptions, headers, and content. On the other hand, off-page SEO focuses on building the bank’s authority through backlinks from reputable websites, social media shares, and online reviews. Banks can collaborate with finance-related blogs and websites to gain backlinks and enhance their credibility.

In addition to traditional technical SEO, banks must invest in local SEO strategies. By optimizing their Google My Business listings and including location-specific keywords, banks can improve their visibility among potential customers in their geographical area.

Chase Bank

This bank successfully improved its online presence through a comprehensive SEO strategy. Chase significantly increased organic traffic by optimizing its website for relevant keywords and creating valuable content. They also focused on local SEO, ensuring the prominent appearance of their branch locations in local search results.

Email marketing

In fact, email marketing for banking remains one of the most effective channels to communicate with their clients. Personalized and targeted email campaigns can significantly increase engagement and conversions.

Banks should segment their email lists based on customer demographics, behaviors, and preferences. For instance, sending custom offers on mortgage rates to first-time homebuyers can enhance relevancy and drive action. Personalized emails (such as birthday greetings with exclusive offers) can foster goodwill and strengthen customer relationships.

Engaging content (financial tips, market updates, and product launches) can keep customers informed and invested. Incorporating visually appealing designs and clear calls to action (CTA) can enhance engagement rates. Additionally, A/B testing different subject lines and on-page SEO content can help banks determine what resonates most with their audience, optimizing future campaigns.

Banks can use automation tools to create drip campaigns, sending pre-scheduled emails to nurture leads over time. For instance, a new customer might receive emails introducing them to different banking products, tips for using the bank’s app, and information about local events. This gradual approach can build customer loyalty and keep the bank top-of-mind.

Read also: The Power of SEM Tools for Digital Marketing

Ally Bank

This bank has effectively used email banks marketing to inform customers about its high-interest savings accounts and various financial products. Its emails often include educational content about saving strategies, which not only drives interest in its products but also builds trust and loyalty.

Paid advertising campaigns

Paid banking advertising can provide rapid visibility and reach for banks, allowing them to target specific demographics and geographic locations. Banks can promote their services effectively by investing in pay-per-click (PPC) campaigns and display ads.

Developing targeted campaigns based on user interests, online behavior, and demographics ensures that banks reach the right audience. For instance, a campaign aimed at young professionals might highlight student loan refinancing options or credit-building products. Banks can create ads that resonate with specific population segments by using platforms like Google Ads and Facebook Ads.

Implementing retargeting bank marketing strategies can help re-engage users who have previously visited their websites. Display ads that follow potential customers across different sites can remind them of the bank’s offerings, increasing the possibility of conversion. Retargeting ads can cover special promotions or new product announcements, attracting users to revisit the bank’s website.

HSBC

This bank has effectively employed PPC advertising to promote its international banking services. Targeting expatriates and frequent travelers has successfully driven traffic to its website and increased sign-ups for its global accounts. Its ads are tailored to highlight unique selling propositions that cater specifically to its target audience.

Mobile applications (ASO)

As more customers turn to mobile banking marketing, optimizing mobile applications through App Store Optimization (ASO) is critical for banks. A well-optimized app can improve visibility in app stores and attract downloads.

Then, banks should prioritize user experience by providing mobile apps that are intuitive and easy to navigate. An app with quick access to essential features (such as balance checking and fund transfers) can boost customer satisfaction. Regular updates to enhance functionality and incorporate user feedback can create a positive user experience.

Actively soliciting user feedback and implementing suggestions can help banks continually improve their apps. Encouraging users to leave reviews and ratings can increase the app’s visibility in app stores, attracting more potential customers. Responding to user feedback promptly can also demonstrate the bank’s commitment to customer service and improve overall ratings.

Capital One

This bank has successfully implemented paid banking advertising campaigns across various platforms to promote its credit card products. By utilizing targeted ads on Google and social media, Capital One effectively reached a broad audience, showcasing its unique rewards programs. Their retargeting campaigns reminded users of their previous interactions, increasing conversions and new sign-ups.

Internet banking

Delivering seamless online marketing of banking services is vital for customer satisfaction. By improving their Internet banking platforms, banks can attract and retain customers who prefer digital transactions.

Emphasizing security features, such as two-factor authentication and real-time alerts, banks can instill confidence in customers regarding the safety of their transactions. They should also deliver educational content on safe online banking marketing practices to reinforce their commitment to security. Transparent communication about security measures can build trust and encourage customers to engage more with online services.

Offering personalized dashboards that display relevant financial information can enhance the user experience. Features like spending analytics, budgeting tools, and goal-setting options can empower customers to manage their finances effectively.

Read also: SEO Title Tag Best Practices: Unleash Your Inner SEO Expert

PNC Bank

This bank has successfully redefined its Internet banking experience by introducing innovative features that enhance customer convenience. They launched a virtual wallet service that integrates seamlessly with their online banking marketing platform, allowing users to manage their finances, pay bills, and track spending all in one place.

Video marketing

Video marketing for banking is an exciting way to convey complex information in an easily digestible format. By creating informative and entertaining video content, banks can improve brand awareness and connect with their audience.

Banks can create videos that explain financial concepts, such as how interest rates work, the importance of credit scores, and investment strategies. These videos can be shared on social media and embedded in emails to reach a wider audience. Using storytelling techniques to create relatable scenarios can make financial topics more approachable for viewers.

Incorporating customer testimonials into video content can make authentic connections with potential clients. Showcasing real-life success stories boosts credibility and fosters trust in the bank’s offerings. By highlighting diverse customer experiences, banks can appeal to a broader audience and display their commitment to serving different demographics.

Wells Fargo

This bank has successfully utilized video banks marketing to promote its financial education initiatives. Their “Wells Fargo Stories” series featured customer testimonials and expert insights on various economic topics. Thus, they provided valuable information and humanized the brand, making it more relatable to consumers.

Artificial intelligence and chatbots

Artificial intelligence and chatbots are transforming customer service in the banks marketing sector. Banks provide personalized support and improve customer experiences by implementing these technologies.

AI-powered chatbots can offer 24/7 assistance to customers, addressing their queries and concerns in real time. This ensures that customers receive prompt responses, even outside regular business hours. Chatbots can free up human agents to focus on more complex issues by providing immediate support for everyday inquiries, improving overall efficiency.

Banks can employ AI algorithms to analyze customer behavior and preferences, allowing them to offer personalized product recommendations. For example, a bank could suggest relevant credit card options or savings accounts that align with their financial goals based on a customer’s transaction history.

DBS Bank

This bank in Singapore has implemented an AI-powered chatbot named “DBS iWealth,” designed specifically for affluent customers. The chatbot provides personalized financial advice, investment insights, and market updates tailored to individual client needs. Integrating iWealth has allowed DBS Bank to offer enhanced service without overburdening its human advisors.

Influencer marketing

Banks and financial institutions can use this bank marketing strategy to reach younger audiences. Banks can tap into their followers’ trust and expand their reach by collaborating with financial influencers or lifestyle bloggers.

It is a great idea to identify influencers whose values align with their brand. Collaborating with influencers who advocate for financial literacy or sustainable banking practices can enhance the bank’s credibility and attract a like-minded audience.

On the other hand, banks can collaborate with influencers to create educational campaigns that promote financial literacy. For example, an influencer could share tips on budgeting, saving, or investing while subtly promoting the bank’s relevant products. This approach provides value to the audience and establishes the bank as a trusted source of financial advice.

Discover Bank

In fact, Discover Bank has effectively utilized influencer banks marketing by partnering with finance influencers to promote its cash-back credit card. By using the influencers’ expertise and authenticity, Discover has successfully reached a wider audience and highlighted the benefits of its card in a relatable manner.

Social responsibility and charity

Banks demonstrating a commitment to social responsibility can differentiate themselves from the competition. Engaging in charitable initiatives and community support can improve brand reputation and foster customer loyalty.

Banks should actively participate in local community events and initiatives, such as sponsoring financial literacy programs or supporting local charities. By aligning their brand with meaningful causes, banks can showcase their commitment to social responsibility and positively impact their communities.

Implementing corporate social responsibility (CSR) banking marketing campaigns can further raise their reputation. For example, a bank could launch a campaign that focuses on sustainability, promoting eco-friendly banking practices and supporting environmental organizations. This approach attracts socially conscious consumers and fosters a positive corporate image.

TD Bank

This bank has effectively positioned itself as a socially responsible institution by supporting various community initiatives. Their “TD Ready Commitment” program focuses on community giving, environmental sustainability, and financial education.

Brand collaborations and sponsorship

Strategic collaborations and sponsorships can improve a bank’s visibility while reinforcing its brand values. Banks can produce unique marketing opportunities that benefit both parties by partnering with other organizations.

Banks should identify potential partners that align with their brand values and target audience. For example, collaborating with a popular tech company to launch a co-branded financial app can attract tech-savvy customers looking for innovative banking solutions. Joint banks marketing efforts can strengthen reach and impact, creating a win-win situation for both parties.

Sponsoring community events or financial literacy workshops can enhance a bank’s visibility while showcasing its commitment to supporting local initiatives. This approach increases brand awareness and boosts community ties. By actively participating in events, banks can meaningfully engage with potential customers.

Citibank

This bank has successfully sponsored various cultural and sporting events, such as the Citi Concert Series, enhancing brand visibility and engaging with diverse audiences. These sponsorships allow Citi to showcase its commitment to community engagement and customer satisfaction, reinforcing its brand identity as a socially responsible financial institution.

Traditional marketing channels

While digital marketing for banks is crucial, traditional marketing channels should not be overlooked. Television, radio, and physical advertisements can still effectively reach target audiences, especially older demographics who may prefer conventional media.

Banks can create integrated marketing campaigns that combine traditional and digital channels. For instance, a television ad promoting a new savings account can direct viewers to the bank’s website for more information or exclusive online offers. This integrated approach ensures that the bank’s messaging is consistent across all channels, enhancing overall effectiveness.

Local newspapers, radio stations, and community events allow banks to connect with their community. Banking advertising in these channels can help banks build relationships with local customers and enhance brand loyalty. Banks can demonstrate their commitment to the community by supporting local businesses or initiatives.

Barclays Bank

This bank was the official title sponsor of the EPL, one of the most-watched football leagues globally. This association significantly boosted the bank’s brand recognition in the UK and internationally.

This partnership increased brand loyalty and trust and created a positive public perception of Barclays, especially among sports fans. It was a vivid example of how traditional marketing channels, combined with high-profile sponsorships, can amplify a bank’s presence on a global stage.

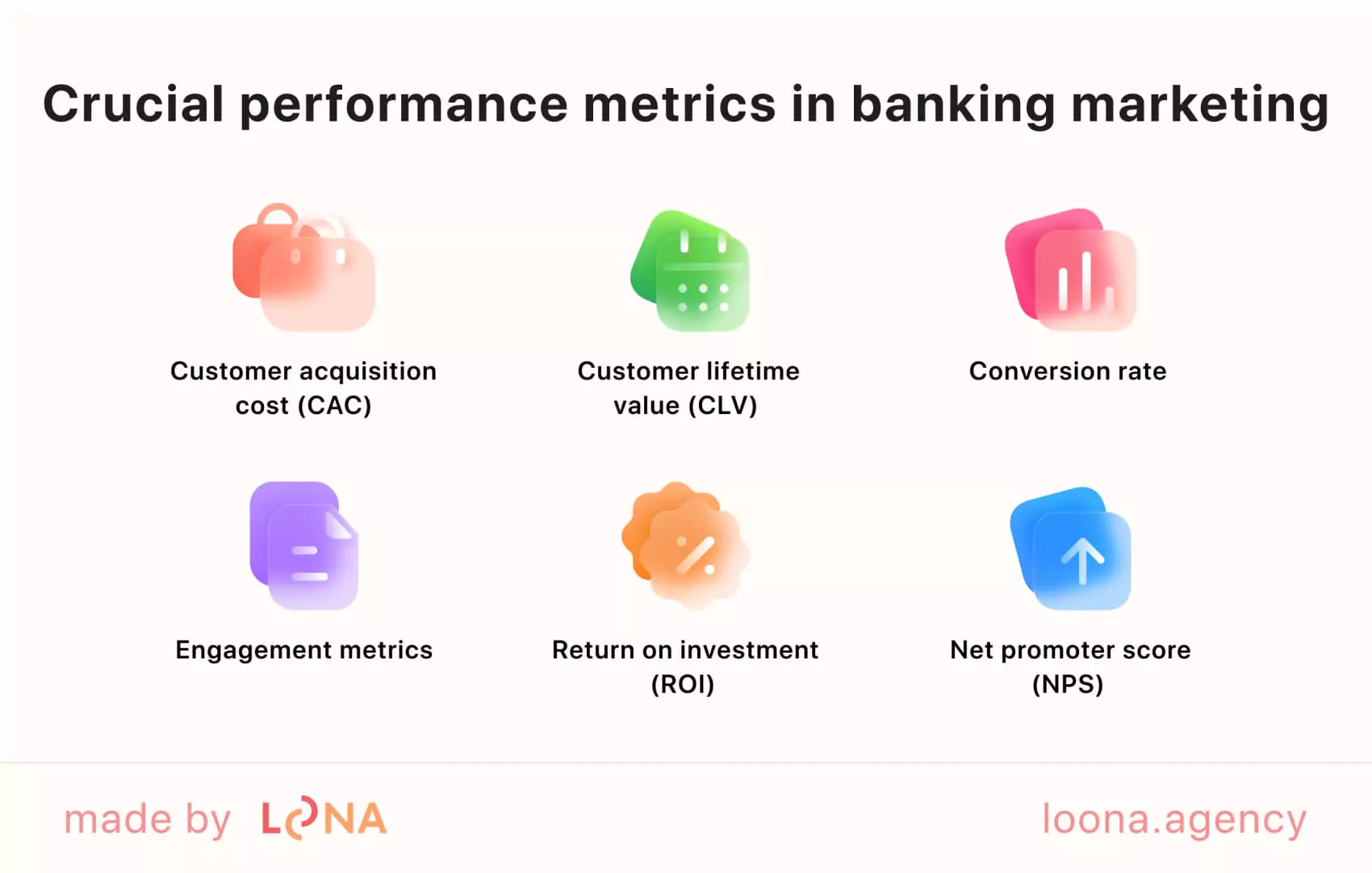

Top metrics in bank marketing

Analyzing marketing strategies’ effectiveness in the competitive banking industry is essential for driving growth and improving customer relationships. To achieve this, banks must focus on several important metrics that provide insights into their banking and marketing performance. These metrics help evaluate the success of campaigns and guide future strategies to optimize customer engagement and increase profitability.

1. Customer acquisition cost (CAC)

This metric measures the cost of acquiring a new customer, including marketing expenses, sales efforts, and any associated overheads. By analyzing CAC, banks can assess the efficiency of their banks marketing campaigns and determine whether their spending aligns with the value of the customers they attract. A lower CAC indicates more effective marketing efforts, while a higher CAC may signal the need for strategy adjustments.

2. Customer lifetime value (CLV)

It estimates the total revenue a bank can expect from a customer over the entire duration of their relationship. This metric is critical for understanding how much to invest in acquiring and retaining customers. By comparing CLV to CAC, banks can gauge the long-term value of their marketing efforts. A high CLV suggests that bank marketing strategies successfully foster lasting relationships and encourage customer loyalty.

3. Conversion rate

The conversion rate measures the percentage of prospects who take a desired action (such as signing up for an account, applying for a loan, or subscribing to a service). Tracking this metric helps banks evaluate their marketing funnels’ effectiveness and identify areas for improvement. A higher conversion rate indicates successful messaging and targeting, while a lower rate may reveal issues in the customer journey that need addressing.

4. Engagement metrics

Engagement metrics, including click-through rates (CTR), social media interactions, and email open rates, deliver valuable insights into how well marketing content resonates with the audience. These metrics help banks understand what types of content drive interest and encourage further interaction. Banks can create more compelling content that fosters deeper customer connections by optimizing engagement strategies.

5. Return on investment (ROI)

This is a necessary metric for assessing the profitability of banks marketing campaigns. Banks can determine whether their marketing efforts yield a positive return by comparing the revenue generated from a campaign to its cost. A strong ROI signifies effective resource allocation, while a weak ROI may necessitate reevaluating strategies to ensure better performance in future campaigns.

6. Net promoter score (NPS)

This metric measures customer loyalty and satisfaction by asking customers how likely they are to recommend the bank to others. A high NPS indicates strong customer satisfaction and can lead to organic growth through referrals. Monitoring NPS helps banks comprehend customers’ perceptions and make necessary adjustments to enhance service quality and overall satisfaction.

Read also: 15 Effective Public Relations Strategies in 2025 (With Examples & Tactics)

Entrust the promotion of your financial product to Loona professionals

At our digital marketing agency, we focus on outstanding solutions that help banks enhance their brand presence, engage customers effectively, and drive growth. Here’s how we can assist your business succeed.

Customized marketing strategies

Our expert team works closely with you to develop customized banks marketing strategies that align with your business objectives. When you’re looking to attract new customers, promote a new product, or improve brand loyalty, we design tailored campaigns.

Data-driven insights

Our agency uses cutting-edge analytics to gather insights into customer behavior, preferences, and trends. Analyzing this data, we help you make informed decisions that improve your marketing efforts and optimize customer interactions. Focusing on measurable results, we ensure that solid data backs every marketing initiative.

Engaging content creation

Content is heart, especially in banking. Our creative team excels at crafting compelling content that informs and engages your audience. From informative blog posts and attractive social media campaigns to targeted email marketing, we ensure your messaging aligns with your brand voice and speaks directly to your customers’ needs.

Performance tracking and optimization

Our specialists continuously monitor performance metrics to assess the effectiveness of our strategies. By identifying what works and what doesn’t, we can make real-time adjustments to maximize results. This agile approach ensures that your marketing efforts are always optimized for success.

Moreover, our case studies demonstrate our ability to adapt the strategies and meet each client’s unique needs while delivering remarkable success. For instance, Intobi is one of our exceptional projects.

We redesigned a platform to fulfill technical specifications while providing an exceptional user experience. Our focus was primarily on the end user, resulting in a visually appealing, intuitive design that makes navigation effortless. We also implemented a scalable infrastructure capable of handling increased traffic, guaranteeing that the platform remains efficient and reliable.

Conclusion

In an industry where trust and relationships are vital, banks must constantly evolve their marketing strategies to stay ahead. The key to success lies in adopting innovation, personalizing customer experiences, and employing data to drive meaningful engagement. The future of banking belongs to those who are willing to mix creativity with technology, creating banks marketing strategies that inspire and build long-term value.

At Loona marketing agency, we deliver robust and innovative marketing strategies that boost your brand and connect you with your ideal customers. Contact us to lead the way in the digital banking revolution!

FAQ

01 What is the bank marketing?

Banks marketing involves strategically promoting a bank's products and services to attract and retain new customers. This covers advertising savings accounts, loans, and other financial products through various channels, such as digital marketing, email campaigns, and in-person engagements.

02 How does marketing work in a bank?

Marketing in a bank works by identifying the financial needs of different customer segments and developing targeted strategies to meet those needs. This process includes market research, creating compelling campaigns, and using multiple platforms to reach the right audience.

03 What are the basics of bank marketing?

Bank marketing basics include understanding customer demographics, building strong brand awareness, and effectively promoting the bank’s products. It also involves market segmentation to tailor products like savings accounts, loans, or investment options to specific customer needs.

04 How to be a good bank marketer?

To be a good bank marketer, you must stay up-to-date with the latest trends in both banking and marketing. This includes mastering digital marketing strategies, using data analytics to track customer preferences, and creating personalized marketing campaigns.

05 How to increase customer base in banks?

Growing a bank’s customer base concerns creating targeted marketing campaigns that focus on the specific financial needs of different customer segments. Banks use referral programs, social media engagement, partnerships with fintech, and digital banking innovations to appeal to a broader audience.

06 How to increase banking sales?

To boost banking sales, banks can focus on cross-selling and upselling their products, such as offering a credit card to a customer with a savings account. Using customer data to identify potential needs and offering personalized solutions can boost conversions.

Love what you’re reading? Sign up for our newsletter to get our newest articles, helpful tips, and fresh marketing updates delivered right to you. No spam, just the good stuff.